10 trends in corporate reporting:

By CEO and communications advisor Lars Sandstrøm, Corporate Relations

ESG has become a key element in corporate reporting. It is included in the key figures, in the business model and strategy, as a significant driver for development and growth, and as a means to secure the company’s license to operate. In essence, ESG affects many of the current trends in corporate reporting.

There are of course some differences from one company to the next in the efforts that are put into corporate reporting. But though industry and size also matter, the amount of compliance and standards are to a large degree comparable at least in the western world. At the moment, much discussion and planning in large companies are regarding EU’s Corporate Sustainability Reporting Directive (CSRD), but this directive is already hitting smaller companies in the value chain as these are asked to comply with a number of new policies and standards.

However, sustainability and ESG is not the only topics on the agenda for companies that prioritise corporate reporting as a means to a value creating communication with a broad group of stakeholders. Corporate reporting needs to present a concise and transparent business model and strategy, it must demonstrate the capacity to develop and grow in agreement with internal and external surroundings, it should deliver guidance for financial stakeholders, and must present risks as challenges as well as opportunities to bring the full picture of the company.

This is all complex. But done well, corporate reporting will play an important role in both investor relations and corporate communication, it will be a tool to ensure a true and fair evaluation and it will serve as a tool to build relations and image. The ten trends presented below is a testament of the focus I see demonstrated in corporate reporting today.

#1 Sustainability as part of the business core

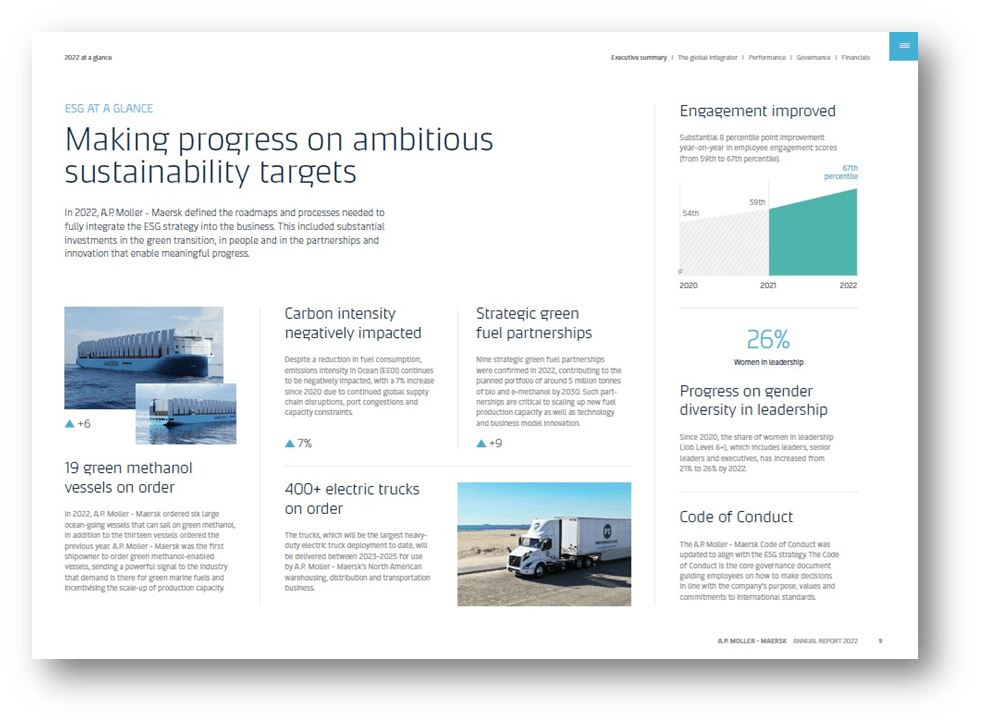

Sustainability – typically included in an ESG framework – is increasingly an integrated part of corporate reporting. It is communicated as an essential part of the company purpose and business model, it is communicated as a major driver for value creation, it is listed as specific posts in the key figures, and it is handled as a significant part of risk management and governance.

Although, most companies are still publishing a separate ESG, CSR or sustainability report, they are also making sure to demonstrate that sustainability is not just a trendy idea or a fancy brand story. Sustainability is part of the strategic initiatives, it is measured, governed by policies, progress is monitored, and results are reported and compared to targets and benchmarks. Also, sustainability is a key element in evaluating which partners and customers you want to do business with.

All this is evident when you look at the most progressive companies’ corporate reporting.

ESG is a central part of corporate reporting and the “at a glance” at A. P. Møller-Maersk.

#2 Focus on materiality and stakeholders

With a more complex compliance and increasing demands from stakeholders it seems like corporate reports have tended to grow in number of pages and topics covered. Especially, the ESG/sustainability part is taking up more space. However, by assessing materiality and critical stakeholders, management will get a concise direction for the review of operations and value creation. Not all sustainability measures going on in a company are equally important, and all stakeholders do not carry the same weight when it comes to sustainability reporting.

Surely, the materiality assessment is part of compliance. But there are many ways to do it. Most companies are using double materiality assessment, which means that they report not only on how sustainability issues might create financial risks for the company (financial materiality), but also on the company’s own impacts on people and the environment (impact materiality).

When it comes to the stakeholder assessment – or analysis – the leeway is bigger. Some say very little about stakeholders and some are doing an extended analysis of critical stakeholders’ position and roles in relation to ESG issues and in relation to the business model and strategy execution.

The materiality assessment and stakeholder mapping are illustrated with a transparent infographics in the annual report of Matas.

#3 A stakeholder-oriented equity story

You could say that all the company communicate is part of the common equity story. You could even say that the equity story – like a brand image – is co-created by all internal and external stakeholders. However, many companies are also directing readers’ attention to an official equity story in the annual report.

This equity story is often directed towards potential investors with a headline like: Why invest in our company? But some are presenting a broader equity story communicating why different stakeholders should choose to have relations with the company. In this way the equity story is taking form of a corporate story.

There are differences in the building blocks of the equity story. Some have a financial focus with technical arguments for an investment, while other have a more holistic focus including elements like culture, working conditions, products and services, sustainability actions, management, ethics, and image. Elements that are typically directed towards customers, partners, political decision makers and employees.

#4 Stronger focus on business model and strategy

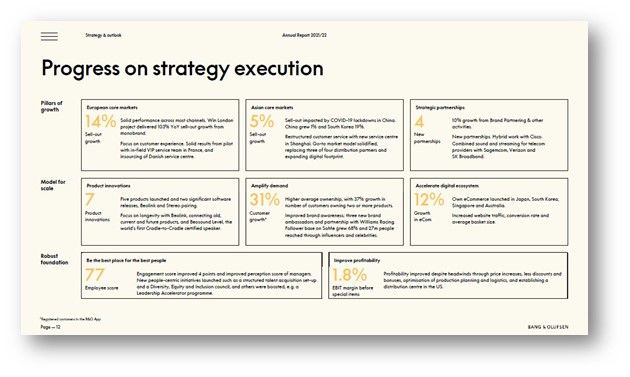

The communication about business model and strategy is taking a more and more prominent role in corporate reporting.

The business model is typically describing the resources/input that companies are relying on, the operations (the core business) that defines the unique offering, and the value creation/output or impact that is the result of the business operations. Often some kind of value or supply chain is included in the model as well as the purpose. It is a clear trend that the business model visualization and as well as description has been improved for many companies in recent years, and the business model also serves as a foundation to understand the strategic priorities and the focus on ESG.

Also, the corporate strategy has come to play an essential role in the annual report. In many cases the strategy section looks backward (reporting on achievements) as well as forward, and it serves as a relevant starting point for reporting on results and measures. Some years ago, management was in general a bit reluctant on being open and transparent in revealing details on targets and planned actions. But the consensus now seems to be that a well-described strategy makes it easier for investors and other stakeholders to evaluate the company and its capabilities to meet future demands for products and services in specific markets.

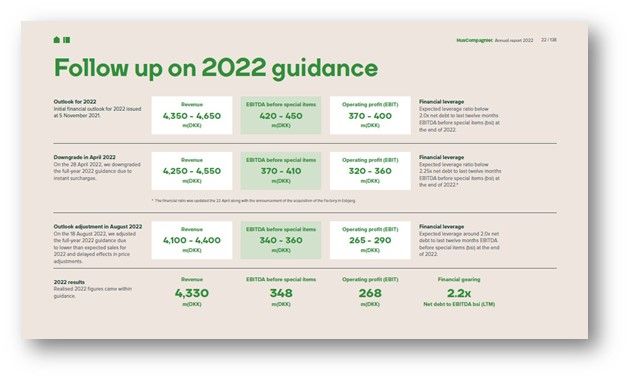

#5 More uncertainty, better guidance

Maybe, you would not believe it. But it seems like companies are using more time on the guidance of financial and business development in times of uncertainty and turbulence than otherwise – and their guidance have become more substantial and detailed in later years. You might even think that management would have greater challenges in predicting the future.

There is definitely a need for more guidance, and regulators and auditors have sharpened their look at how companies describe their expectations for the future. But investors and other stakeholders are also demanding more transparency on how companies’ future results are affected by internal and external factors.

Many companies are striving to meet these demands and have developed quite technical prediction models to describe how different scenarios can affect key figures. This might not be new, but as readers of annual reports we are getting more insights into what these models have calculated and into which uncertainties are included in these calculations.

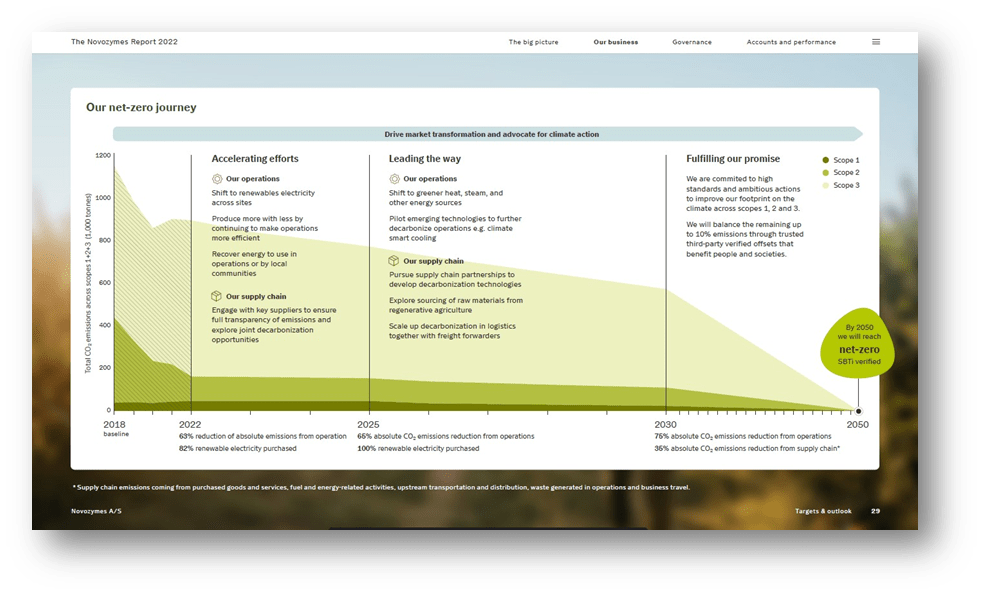

#6 Clear targets and results on ESG

So far, ESG reporting has been a subject to soft law. These means that most of the reporting in this field have been voluntary and very little has been mandatory. This is about to change with the current implement of EU’s Corporate Sustainability Reporting Directive (CSRD).

However, many companies have already gone very far in their reporting on ESG results and measures. E.g., the standards in the Global Reporting Initiative (GRI) are used by more than 10,000 companies worldwide, and in Denmark the ESG guidelines supported by CFA Society Denmark, FSR, and Nasdaq Copenhagen have become very popular as a framework for reporting on this topic.

Most large companies – especially in the western world – have defined and are reporting clear targets for the ESG strategy and are reporting on results and improvements on a year-to-year basis. Often these results are not only internal but are also concerning material parts of the supply chain. And when it comes to greenhouse (GHG) emissions, targets are increasingly science-based to ensure transparency and comparability, and to ensure companies are heading in the direction towards living up to the 2015 Paris Agreement.

#7 Diversity and inclusion are hot topics

Describing initiatives and results in relation to people and culture is an essential part of corporate reporting. Especially, the terms diversity and inclusion have been hot topics in corporate reporting in recent years.

The description of results and measures on these terms includes a lot of variety from one company to the next. It is regulatory to describe gender diversity in top management, but diversity is often also reported in regard to race, religion, and nationality and in regard to different types of education, function and types of personality. Also, when it comes to inclusion companies are describing how they help people with disabilities or how they work with NGOs or the local communities to include people in their staff who would otherwise have difficulties getting a meaningful job.

These topics are not just subject to pure storytelling. Companies are using various measurements to document their results – they use engagement surveys and measure employees participating in training and education, they implement dashboards on performance, promotions, and equal pay, and they calculate the percentage of socially inclusive positions. To name just a few ways to measure progress.

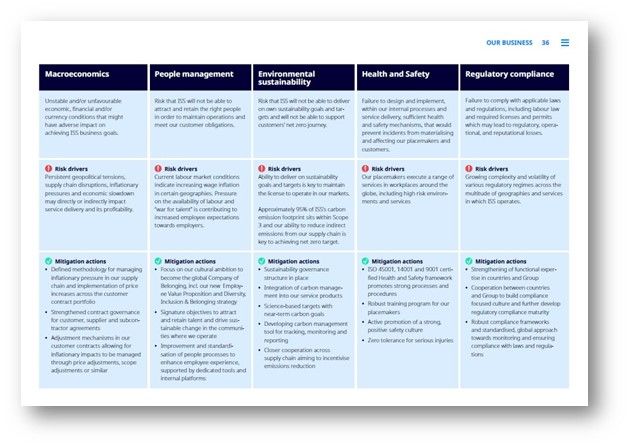

#8 Governance and risk management is central

Governance and risk management are disciplines which to a large degree are affected by compliance and standards. Therefore, annual reports – or special governance and/or risk reports – typically describe topics like role of management, responsibilities of the Board, risk defence model, gender diversity, anti-corruption and fraud, human rights, ethics, and the existence of a whistle-blower scheme. Surely, these are all topics companies have been focusing on with varying weight the last couple of years.

So far, reporting on risks has been treated very conventionally. It seemed like an outsider could easily define and describe the risks related to financials, business and ESG for a given company. But reporting on specific and changing risks and risk mitigation has been improved in later years and are now described with substance and relevance regarding the situation and context of the company. Risks are analysed and monitored, changes in status are evaluated, and mitigation is part of a systematic approach ensuring companies have the relevant tools to balance risk and opportunities.

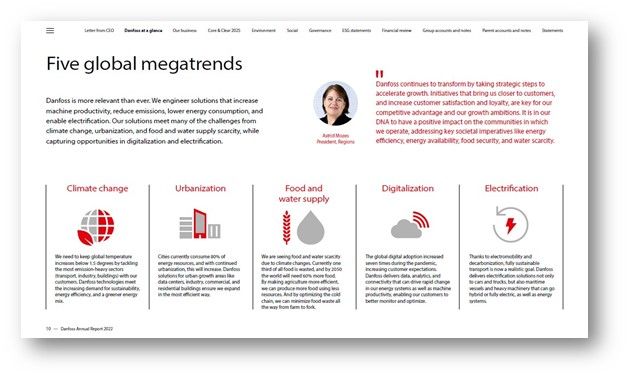

#9 Communicating trends in society, market, and industry

Companies are responding to trends in society, market, and industry to be able to meet customers’ and consumers’ demands, and to be able to develop a unique position and brand image. And their understanding of current and significant trends is also reflected in corporate reporting.

There are many ways to describe trends. Some describe business opportunities in the light of general megatrends, some describe external and internal trends affecting their business in both positive and negative ways, and some describe specific industry and market trends, their impact on business strategy and operations and how the company responds to these trends and impacts.

Reflecting on trends is an element in reimbursing the strategy and position of the company, and it is a way to demonstrate that the company’s products and services is relevant now as well as years to come.

#10 Cases bring stories to life

The endless numbers and figures in corporate reporting can sometimes be a bit of a challenge to the readers. In addition to using design, photos and infographics many companies are presenting relevant customer stories, innovative projects, social programmes, partner relations or events to bring lively examples of how specific people are relating to other people to execute the strategy in real life.

These cases and features are typically key examples of how the company are working in partnerships and on projects that are progressive and innovative in the market or in regard to an environmental or a social transformation.

Where do we go from here?

It seems to be contradictory that integrated reporting is so strongly promoted at the same time as more and more targeted and thematic reports are introduced to the corporate reporting universe. It is not unusual to find an annual report, a sustainability report, a governance report, and a remuneration report on corporate websites of larger companies. Some even have several sustainability reports structured by different standards or themes, some publicise a special risk report and some a strategy report.

Still, the overall trend is clear. Corporate reporting is at one hand met with more regulatory demands and standards and are on the other hand becoming more open and transparent, more holistic, and are communicating to a broader group of critical stakeholders.

This is not to say that corporate reports are the go-to document when you want to get an overview of a specific company as a customer or candidate for an open position. Though many companies have done a good job in providing an “at a glance” or “in brief” section and are using design and infographics to illustrate complex matters, the corporate reports are still not cosy bedtime-reading. To a large degree you must be a professional reader to understand the financial terms and the ESG standards, to fully grasp the situation of the company today, and to be able to form realistic expectations for the future of the company.

However, to the professional readers (e.g., analysts, investors, press, NGOs, and government) the corporate reports are increasingly a trustworthy and transparent source for measured and documented results and actions defining the strategy execution and operations. And though the many new regulatory steps might seem both tiresome and troubles, it will also bring more insight, better tools for comparisons, and more concise analysis and evaluations of the company.

Link to pdf of this article – by CEO and communications advisor Lars Sandstrøm, Corporate Relations