By CEO and communications advisor Lars Sandstrøm, Corporate Relations

DIRFdagen 2022 clearly demonstrated that IR is going through big changes; in the role and function for IR, in priorities and focus on stakeholders, and in how we communicate with and report to the market.

The song remains the same

As an IR professional present at DIRFdagen ‘22 at Dansk Industri, you might think that the song remains the same. Every year we hear of big changes hitting our companies and the IR function and role. But somehow, we seem to adapt. We find new ways to deal with changes in compliance, stakeholder demands and externalities.

That said, many examples and statements from DIRF DAGEN underline that the last couple of years has been a true ordeal for the IR profession. And troubling waters are still ahead. Just consider the current macro economy and look at what is coming regarding reporting directives and standards from EU on sustainability, and you will know what I am talking about. There is plenty of challenging work for the IR function today as well as in the years to come.

Stairway to heaven

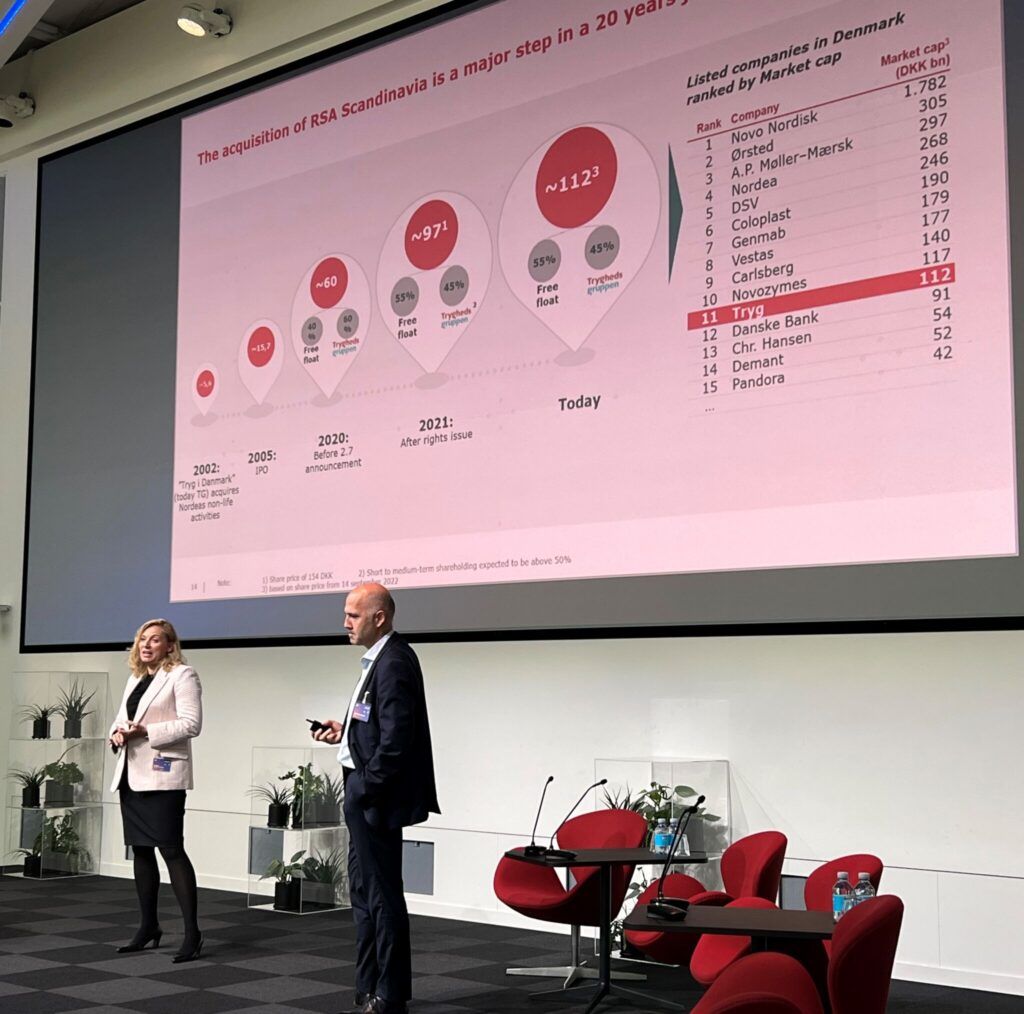

The first presentation at DIRF DAGEN came from Barbara Plucnar Jensen, CFO, and Gianandrea Roberti, Head of IR and External Reporting, both from Tryg. They demonstrated that creating the largest Scandinavian non-life insurer by acquiring RSA Scandinavia (Trygg-Hansa) was a question of timing. The ambition from Tryg had been there for a long time and matched the mission of Tryg, but due to Corona and other circumstance the time was right in the beginning of 2021.

The equity story was key to a successful acquisition. Tryg had to create a credible narrative that demonstrated that the merging companies were a match in identity and culture, and that there was a lot of synergies to reap from the merger. The deal had to make sense financially and strategically, and the narrative had to convince a lot of internal and external stakeholders.

The coming years will show if the “promised” results will be realized. However, Tryg has been successful with this before – most recently with the acquisition of Alka, and stakeholders seem to have trust in the capabilities of Tryg.

Good times, bad times

The landscape of ESG is changing, and to companies that is a signal of both good and bad times. That was clear from the debate in the panel consisting of the chairman of the committee for Good Corporate Governance, Lars Rasmussen, non-executive director of JP Politikens Hus, Andel Energi etc., Jeanette Fangel Løgstrup, and EVP, head of IR Flemming O. Nielsen and EVP, Group Sustainability & Compliance, Martin Andreasen – both at DSV.

Lars Rasmussen: “Companies are often seen as bad guys. Not least from the EU and some politicians. We need tools to help companies on the way to get perceived as a friend of society. The 40 recommendations for good corporate governance are part of the answer to that, but it’s not enough. We need to communicate and follow a clear purpose that explains why we are here.”

That may sound simple, but Jeanette Fangel Løgstrup made it clear that there is work to be done. Especially in the field of ESG: “We are on a burning platform when it comes to ESG. Earlier, we needed to present a business case to be able to invest in and work with ESG and sustainability. But that was yesterday. Today it is an obvious job to be done. It is a challenge, but also a way of pursuing business opportunities from the growing attendance to sustainability. E.g., it is an opportunity to get access to green investments. But it is not an easy task. Pursuing green business opportunities demands focus on culture, your impact on the environment, people and society, your business model and governance. It all needs to be integrated.”

Flemming Nielsen: We know we need to go from ”good enough” to being ambitious. And we are on the way. ESG does not take a lot of time and space with typical meetings with fund managers and analysts. But it is treated separately. However, a large part of the job is not just about doing good. We also need to navigate in all the regulation, and now there is a big difference whether we talk to EU or US investors on ESG”. Martin Andreasen is supporting this: “ESG is a long-term job – and you need to work on it today. We need to be on the forefront. If we don’t, we will be criticized by our stakeholders.”

All agreed that ESG is a complex and growing field. All are looking forward to common standards in ESG reporting as part of an integrated report. And all agreed that it is important to define what is material for the company and its stakeholders in deciding where to focus on your business as well as in your reporting on ESG.

When the levee breaks

If you look at energy prices and inflation in a global perspective, it might look like the levee of stability has been broken and is impossible to repair. Las Olsen, Chief Economist of Danske Bank was surely pessimistic on the Danish economy in the short term, but could also present a lot positive ways to recover long-term. As he said: “It is only a cyclical crisis not a structural crisis.”

Las Olsen draw the current crisis back to the beginning of the COVID-19 break-out. In the years of COVID-19 the economy was boosted. And with reduced supply and boosted demand comes inflation. But there are also several other factors driving the economy and the inflation. E.g., some companies have increased their prices a lot more than the average inflation, and that drives inflation even higher.

The solution according to Las: We need to reduce demand. Then inflation solves itself.

But central banks also need to do their jobs, and now they act a little late.

So, when is the levee fixed again and the economy recovered? We must expect the current recession to go on for a year or so. That is the usual scenario. And already now, we are seeing that the pressure on inflation has started to ease. So, it might still be a bit downhill from here, but we must remember that it is from a high starting point. We will eventually get back to the situation from before COVID-19, Las concluded.

Houses of the holy

Well, they might not be the houses of the holy, but ATP and Blackrock are surely purpose-driven and influential when it comes to setting the agenda for investments in sustainable businesses. And while there might be similarities in investment strategies in the two companies, Claus Wiinblad from ATP and Benjamin Friedrich from Blackrock also made it clear that their approach to active ownership is somehow different.

ATP has a long tradition of being in close dialogue with companies. And that dialogue is taking place both behind closed doors and in the open public domain. ATP is not hesitant to speak up on financial or ESG issues in the media and other open channels. They want their opinions and viewpoints to be broadly known among companies. The objective? “We want to develop companies in a good way – and to benefit pension savers long-term”, as Claus Wiinblad stated.

The communication strategy of Blackrock seems a bit different. They do not communicate on investment and governance issues to the press. But that does not mean that Blackrock’s viewpoints on central issues, e.g. on ESG, are not communicated openly through other channels. The most central topics is presented once a year and there is an intense dialogue with companies in the investment portfolio. And Blackrock’s opinions matter. Recently, Blackrock promoted TCFD reporting, and today we see a lot of large, listed companies following that standard. The impact of Blackrock is quite visible.

Communication breakdown

ATP and Blackrock are extremely large investors on a Danish and International scale – and they have a lot of money to invest. But in general, the investment market is under pressure, and especially it is hard for a lot of smaller listed companies to get sufficient funding to grow. The market is experiencing a bit of a communication breakdown in this respect. This was also clear from the panel talk with founder and CEO of HCA Capital Tue Østergaard, AVP Nasdaq CPH listing Carsten Borring, CEO Danish Shareholder Association Michael Bak and CEO of GomSpace Niels Buus.

A solution is not evident. Both Tue Østergaard and Michael Bak promoted the importance of retail investors and the importance of smaller companies addressing this group. Carsten Borring agreed that the investment market is under pressure, and especially smaller companies are hurt. But it is difficult to address retail investors because they have low appetite for risk.

Niels Buus presented a real-life case through his own company GomSpace which have chosen to be listed on the Stockholm stock exchange. He claimed that one of the reasons why smaller and newly listed companies had challenges raising money was because these companies were judged as an investment like any other. But these companies are not professional companies, they are venture companies, which include risks, but also great opportunities for investors investing in these companies.

Trampled under foot

The macro-economic situation, the pressure on markets and the changing landscape of ESG are all elements affecting the position and role of IR. That could be concluded from the panel of IR professionals at DIRFdagen. And with more compliance, more policies, standards, and guidelines coming towards IR professionals just now and in the coming years, the position could seem a bit trampled underfoot.

Lea Vindvad Hansen, Everfuel: “While we see an increased interest in our shares, it is important that we are consistent and clear in the way we tell the story of our company. In this story, and in our work, ESG is taking more and more space”.

Mathias Holten Møller, Demant: “We have a lot of focus on macro issues and how we navigate in this. This is also a central part in our engagement with stakeholders. We need to explain how we adapt to changing times. That is included in our storytelling.”

Jannick Lindegaard Denholt, FLSmidth: “We need to rethink our engagement model. Macroeconomics is top of mind, but as IR professionals we must know the business in depth as well as details in sustainability. That is challenging.”

Christina Rønde Hefting, HusCompagniet: “A lot of my time has been concentrated on establishing the IR position and role in the company. An important task has been to define what investors are looking for, and from that form the way we communicate with press, and how we develop our reporting.”

All agreed that success to the IR role was gained through a consistent and common thread in what the company says today and 2-3 years from now. The story should be understood and recognized by “educating” stakeholders, and transparency and credibility is key.

Thank you – EU

The European Commission are busy. Especially, the process of drafting, editing, approving, and implementing the new directives as regard corporate sustainability reporting (CSRD) seems effective. The IR professionals are already quite busy, so it’s not a whole-hearted “thank you, EU” coming from their side.

However, the CSRD are not the only area affecting the reporting landscape and the role of IR. That was clear from the presentation on the subject from Kristian Koktvedgaard, Head of VAT, Accounting and Auditing at DI, and a board member of EFRAG. There are several accounting trends, there is digitization (E.g., XBRL) and then there is a number of requirements in sustainability reporting coming our way. And “requirements are being made at an unprecedented pace” as Kristian Koktvedgaard concluded. So, there is plenty of work to be done over the coming years for IR professionals and companies.

All the changes and new requirements will have a significant impact on coming corporate reporting. Thomas Steen Hansen, Director KPMG Investor Relations Services: “An annual report of 400 pages will be a nightmare. We need to look at how we are using different reporting tools. E.g., annual reports are not so much directed to analysts and large investors. They look to the quarterly reports for information.”

Executive Creative Director & Partner, Philip Linnemann, Kontrapunkt: “I think you should see the annual report as a summary and then recognize that private investors are getting a larger role in IR and that they are also an important target group of the annual report. Also, it is important to integrate the typical content of an annual report into other channels.”

There is a lot of priorities to be taken over the next years. ESG will take a big part of the discussion. And one important job will be to both define the costs and the business opportunity values of your ESG strategy. And in the role of IR, you need to find out what is important to the company and to your stakeholders.

Note: all middle rubrics above are titles of Led Zeppelin songs that reflects the changing landscape and role of IR quite well. So, just to finish off with another title, I hope this does not leave you dazed and confused.